Capital Markets: Pay To Play | Why Debt is More Expensive Right Now | September 2022 Special Report

As Higher Interest Rates Disrupt Lenders' Financing Mechanisms, Spreads to Borrowers Climb Higher

Tightening Monetary Policy kicks off widening spreads by lenders.

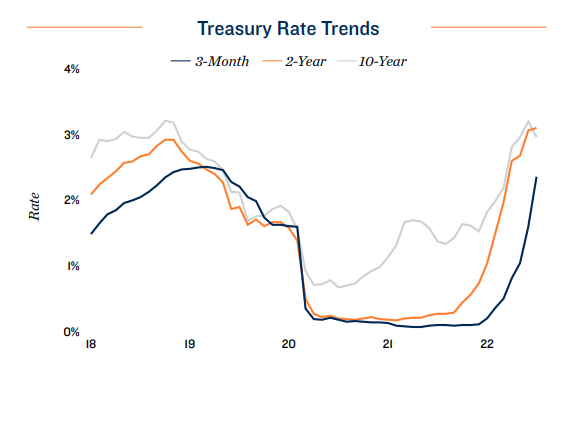

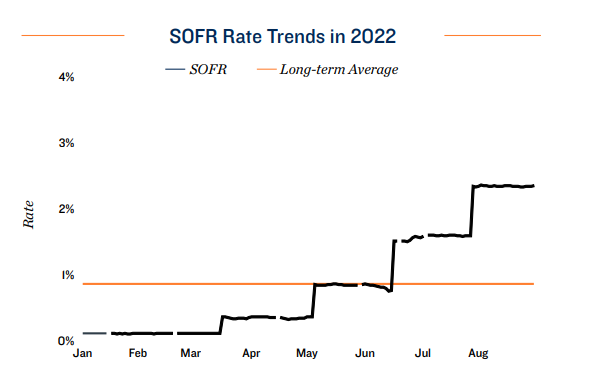

Since the first federal funds rate hike in March 2022, the capital markets have been disrupted, due to financial market volatility revolving around inflationary pressures and expectations of an upcoming recession. Whether these concerns are warranted or not, they have resulted in not only higher base rates in benchmarks, such as the Secured Overnight Financing Rate and Treasuries, but also higher spreads for permanent financing, bridge financing, and to a lesser extent, construction financing.

Wider spreads compound challenge from cap rate compression.

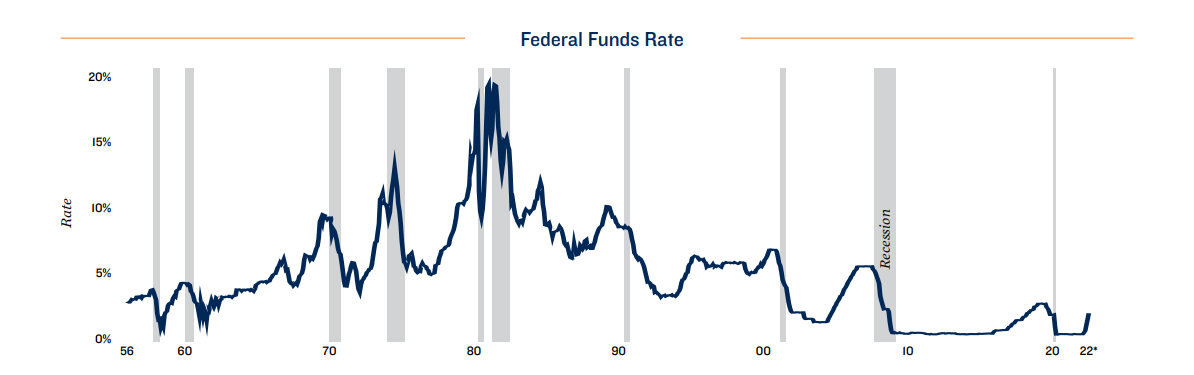

Interest rates are not historically high. The current fed funds rate is only 2.33 percent, nearly identical to the April 2019 rate of 2.44 percent, and well under the September 2006 measure of 5.34 percent. Yet, borrowers are currently hamstrung by interest rates, due to the historical cap rate compression that has occurred over the past decade, combined with a widening spread from lenders. The pullback in overall leverage that lenders are willing to lend at is tied directly to cap rate inflation concerns. However, the reason spreads are also wide is more complex.

Ways of manufacturing yield key to interpreting spreads.

There are multiple methods by which lenders manufacture yield to achieve their required returns. As the demand and liquidity behind these methods declines, it results in increased spreads. Understanding the base root of spread inflation can give real estate investors a basis on which to anticipate where spreads may move to in the future, based on lenders' internal financing and liquidity

Lender Financing Method: Securitization (CMBS/CLO)

CMBS and CLO markets create yield by pooling individual loans.

Securitization is the process by which commercial real estate assets are pooled into risk-rated tranches and packaged as interest-bearing securities. The Commercial Mortgage-Backed Securities (CMBS) market is the gold standard for this process. Certain lenders originate loans and then issuers take over, and tranche pools of these loans based on ratings provided by specific ratings agencies. The resulting bonds are then sold to investors. The loans in CMBS are all collateralized by assets that are stabilized at the close of the securitization, indicating property occupancy was generally at or above 80 percent for commercial properties and 90 percent for residential dwellings. The Collateralized Loan Obligation (CLO) market mirrors CMBS, though the underlying commercial real estate is in transition, not stabilized. The loans collateralizing those assets are also on a floating rate. A variety of factors contribute to the credit ratings of the loans used in CMBS and CLO. The higher the in-place net operating income a property has, the more likely there will be reduced spread, as these assets have reduced risk and are rated more highly. Similarly, product type plays a role in the spread. Multifamily and industrial assets are currently considered less risky than retail, hotel and office properties, which have been more challenged by the recent health crisis.

Risk retention rules critical part of lender process.

Per the Dodd-Frank Act, any institution securitizing a pool of commercial mortgage must retain at least 5 percent of the bond. The institution can choose, however, which 5 percent piece of the securitization pool it holds. There are three types of risk retention that lenders can opt to have - vertical, horizontal and L-shaped. In vertical risk retention, the lender holds onto a small part of each credit tranche, effectively matching the risk profile of the larger securitization. Lenders could also opt into horizontal retention, where they take a first-loss position. In this case, the value of the holding is based on actual proceeds (market value) instead of notional values, as in the vertical option. In an L-shape retention, lenders combine a vertical and horizontal position. In all cases, the originating lender is selling off 95 percent of the loan to third parties, thus manufacturing spread on the piece they hold. Risk retention rules are similar for CLOs, but the market determines the true risk retention by the issuing bridge lenders, which is typically around 20 percent in today's market. Note that during more frothy periods, 15 percent can be more common, further juicing returns for the lender syndicating the loans, resulting in a better spread to borrowers.

Circumspect bond market lowers hold yield, pushing up spreads.

This securitization process relates to today's rising spreads from permanent financing and bridge lenders because those using this tool to manufacture yields are faced with a less aggressive and more risk-averse bond buyer market. Before the Federal Reserve began hiking rates this year, CLO spreads for securitized pools were generally between 150 to 155 basis points, but are now 325 basis points or more. The additional 175 basis points of spread reduces the effective yield of the lender's hold piece, and translates to lenders charging higher spreads over the base term SOFR rate to borrowers. For CMBS, the low-risk AAA spreads have gone from 54 basis points to 68 basis points over the same period, while the higher-risk BBB spreads have widened from 374 basis points to 558 basis points, again resulting in higher spreads over the Swap rate.

Lender Financing Method: Warehouse and Repo Lines

Lenders utilize bank credit to create yield on originations.

Lenders are not constrained to the securitization market when looking to manufacture yield. They can also pursue warehouse and repo lines of credit. This is especially common in the bridge lending space. These credit lines allow lenders to easily leverage their positions, effectively creating promissory note financing on the loans they originate. Large commercial banks, in particular, provide credit lines to private lenders looking to earn yields of 10 percent or more on loans they originate. By charging a single-digit spread and then effectively leveraging their position, lenders can attain these yields by putting the senior portion of their note on the line.

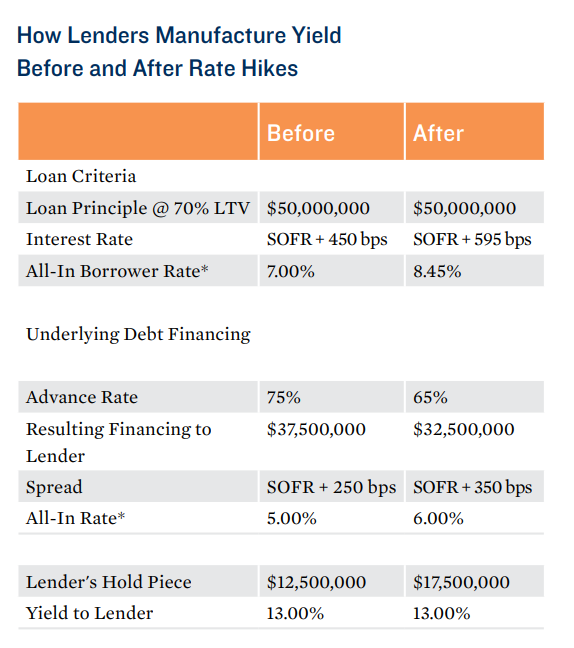

Higher bank spreads to lenders effectively passed on to borrowers.

When the capital markets became disrupted, these large commercial lenders reduced their advance rates, widened spreads or denied warehousing certain potential loans. This resulted in less effective leverage or wider spreads to the originating lender, which, in turn, reduced their effective yields. Lenders have thus increased their spread to borrowers, in order to maintain similar yields to those attained pre-rate hikes.

Lender Financing Method: Note-on-Note, A/B and Senior/Mezz Financing

One-off secondary market transactions provide other yield options.

Lenders can also finance their positions by laying off a senior position in their debt stack to a third party. While this creates a similar yield producing mechanism to others described above, these actions are executed on a one-off basis by the lender. This is most commonly done by debt funds who work with a variety of banks to manufacture their yield in this manner. While the semantics of the differences in collateral between note-on-note financing, A/B structures, senior/mezzanine structures, and the associated rights and remedies to the lender vary, they all result in similar returns to the originating lender. The certainty of execution of these transactions is reduced versus warehouse/repo line financing, as there is not a set capital provider at the time the debt fund bids on the transaction in question.

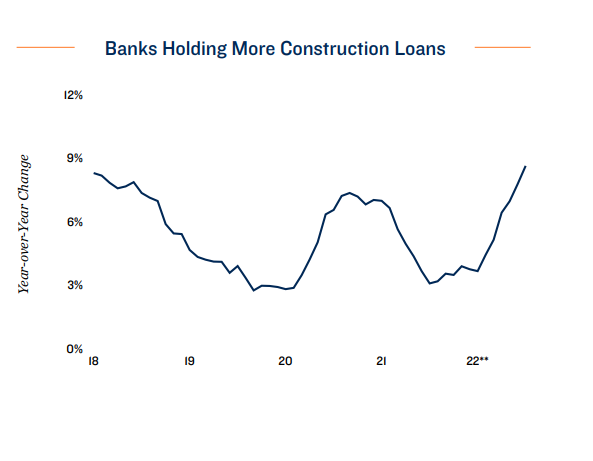

Lower bank leverage has downstream impact for construction loans.

Since the Fed began hiking rates, the underlying senior banks have reduced leverage and increased spreads, resulting in reduced yield to the originating debt funds. This has caused increased pricing across the capital stack on larger transitional deals, including construction loans. While construction loans seem to not be under immediate threat by the short-term implications of today's market conditions, lending has been affected by lenders seeking opportunistic gains, given market illiquidity and rising yields on less risky transaction profiles. This has led to a rising tide that has lifted all spreads across the real estate lending spectrum, impacting every deal profile in the market.

Cascade Effect Across Financial Markets Widens Spreads for CRE Borrowers

Wider spreads to lenders lead to wider spreads for borrowers.

Understanding how lenders generate returns is key to conceptualizing potential interest rate movements. The bond investment market demand drives spreads for securitizations, while commercial bank aggressiveness affects the repo/warehouse lending market. Underlying non-recourse bank debt spreads affect debt funds pricing directly, and those spreads will not come down until the CLO and repo market make debt more affordable on less risky transitional deals. In other words, there is a cascading effect in the capital markets that occurred due to volatility. That relationship could easily cascade in the opposite direction if the volatility were to stabilize, however, creating some potential upside. In the current environment though, market illiquidity creates a supply/ demand imbalance that makes more complicated transactions more difficult and expensive to finance. This results in better profile deals falling to hard money and private lending sources than they could normally transact in a less volatile market.

Spreads join other considerations to influence deal timing.

Whether to wait for interest rates to reduce or execute during these volatile times is a decision that will be likely be driven by other important factors for each transaction. These include reduced opportunity, increased time and carry, and a lack of certainty of future events. That said, setting the knowledge base to understand how interest rates can fluctuate is the first step in setting the foundation of making the important financing decision of whether or not to pay to play for each transaction.