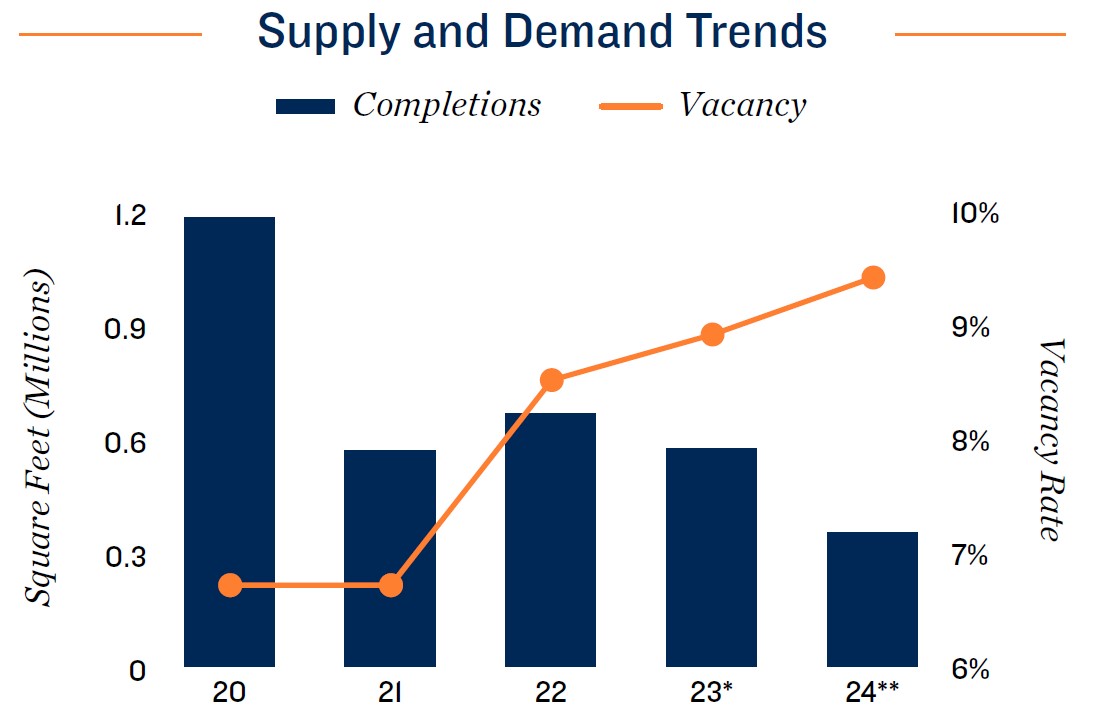

Texas Cities – 2024 Self-Storage Investment Forecast

AUSTIN

Corporate Investments Boost Young Renter Population

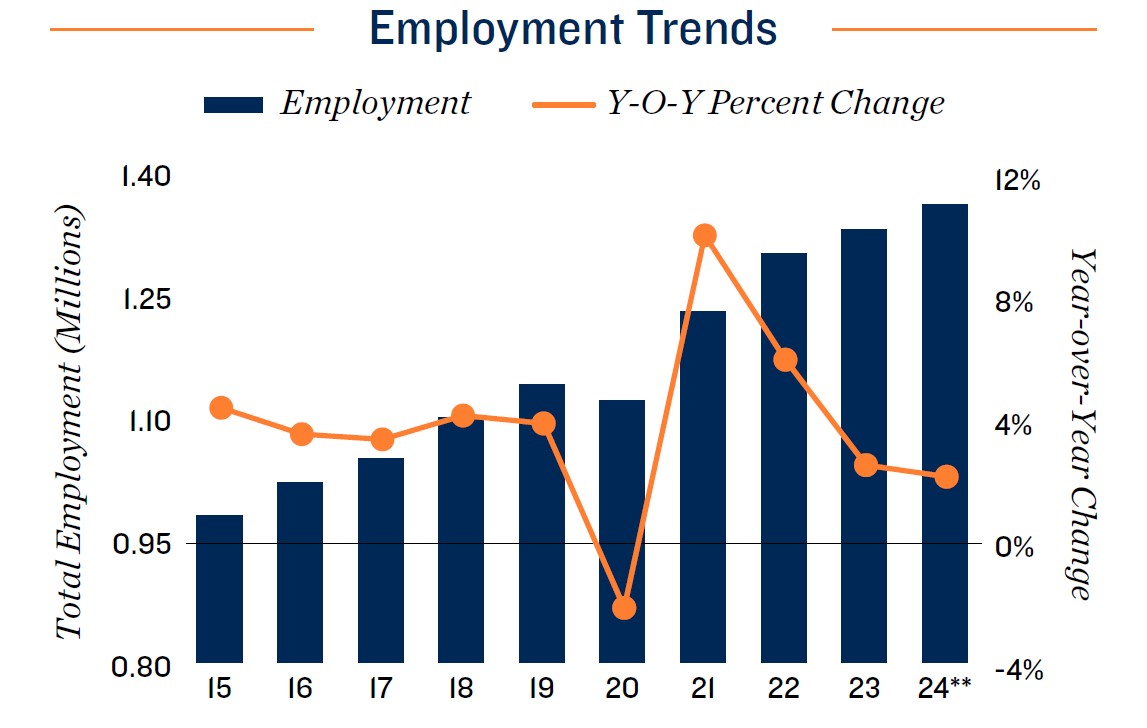

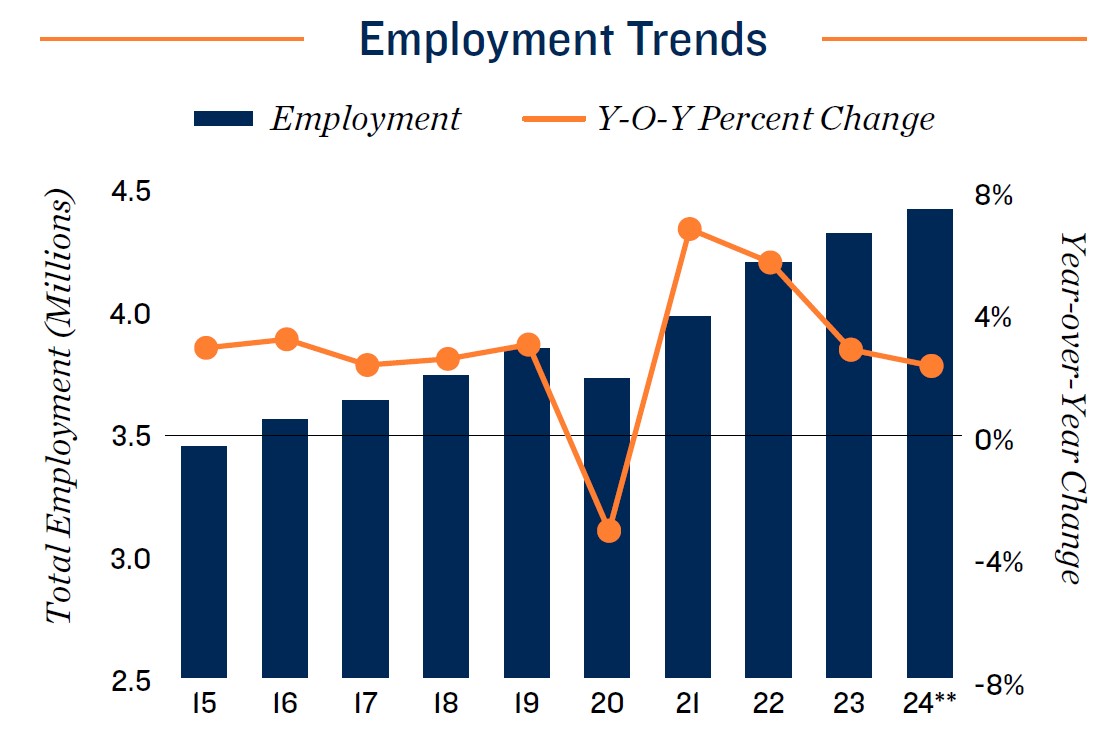

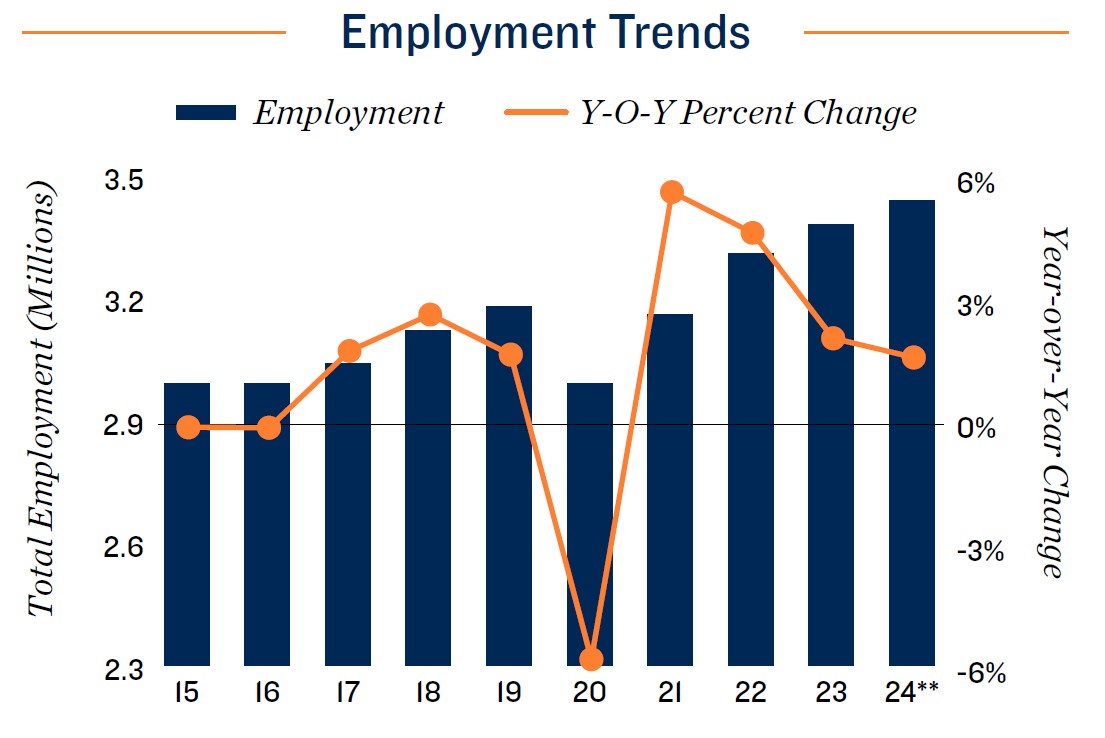

Economic Trends

Long-term employment growth in Austin is aided by companies like Tesla, Apple and Oracle relocating or expanding here. Other projects like Samsung’s semiconductor factory underway in Taylor will deliver this year, drawing new residents to staff the facility and support local self-storage demand while employees settle.

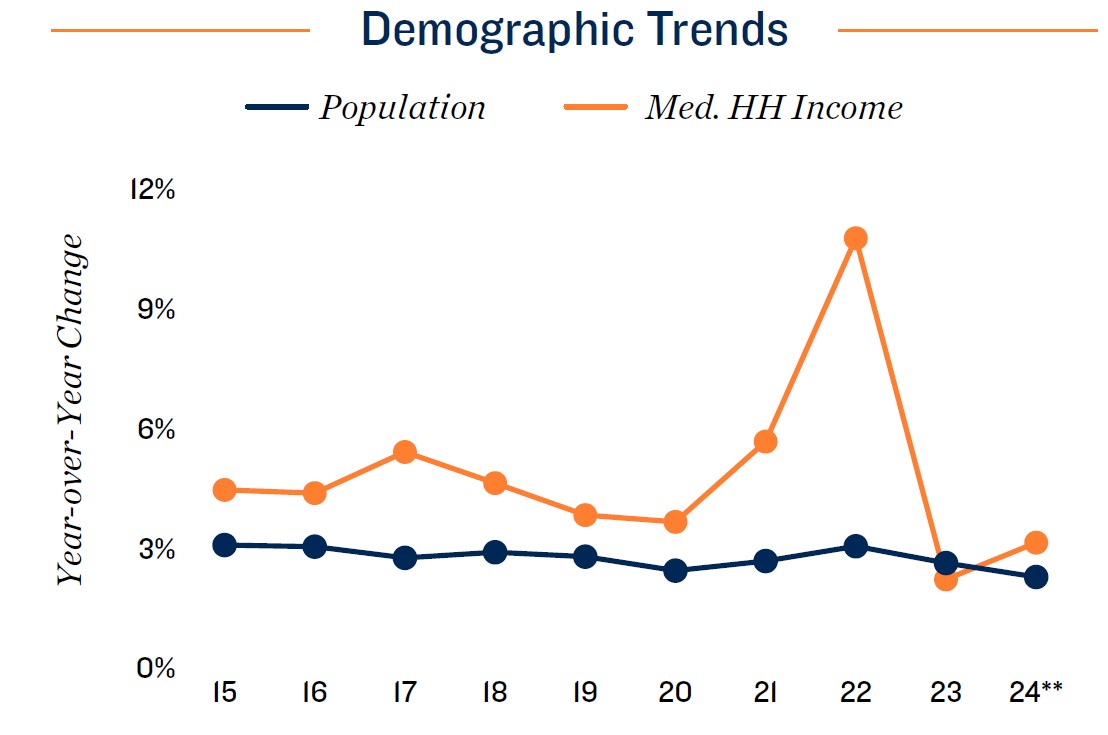

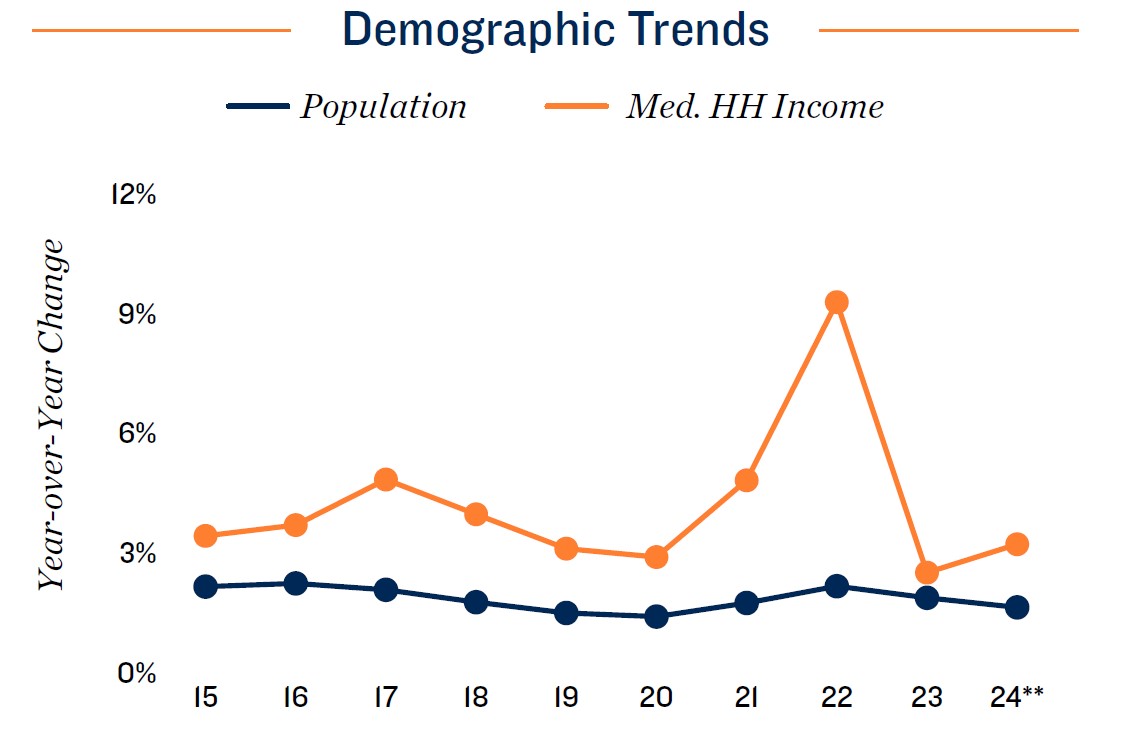

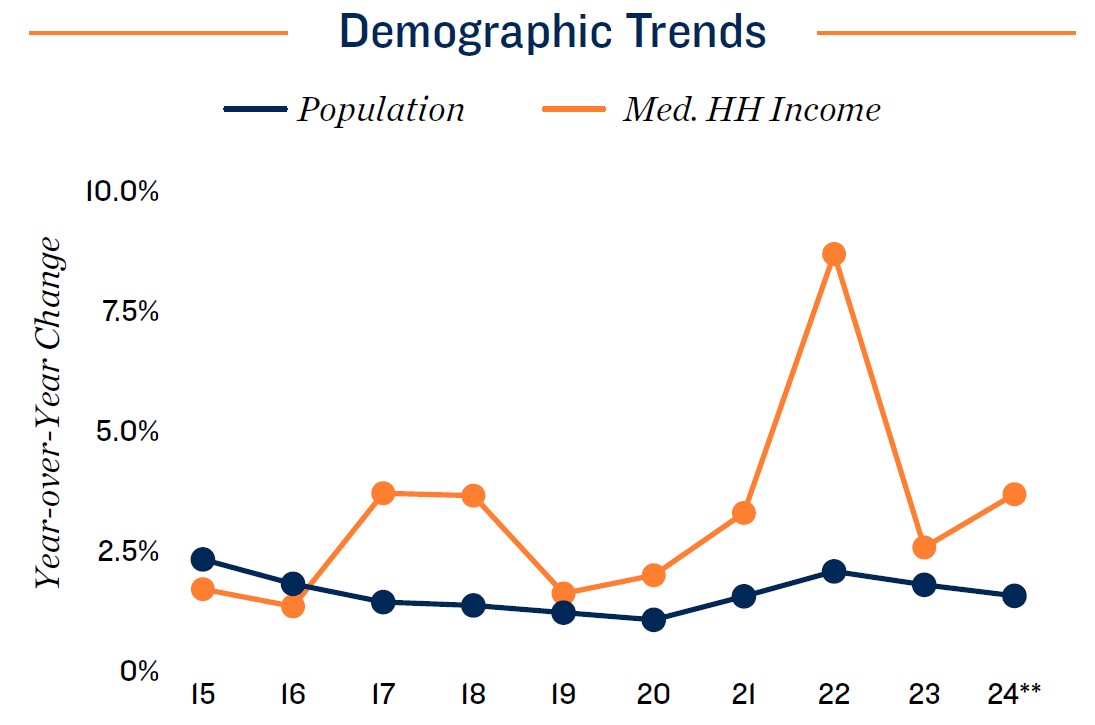

Demographic Trends

The metro’s 20-to-34-year-old cohort will expand by 2.1 percent this year, the fastest increase among any major U.S. market. This segment is traditionally prone to renting, which will support self-storage demand as apartments tend to have limited available free space. The formation of new families and households can also necessitate storage.

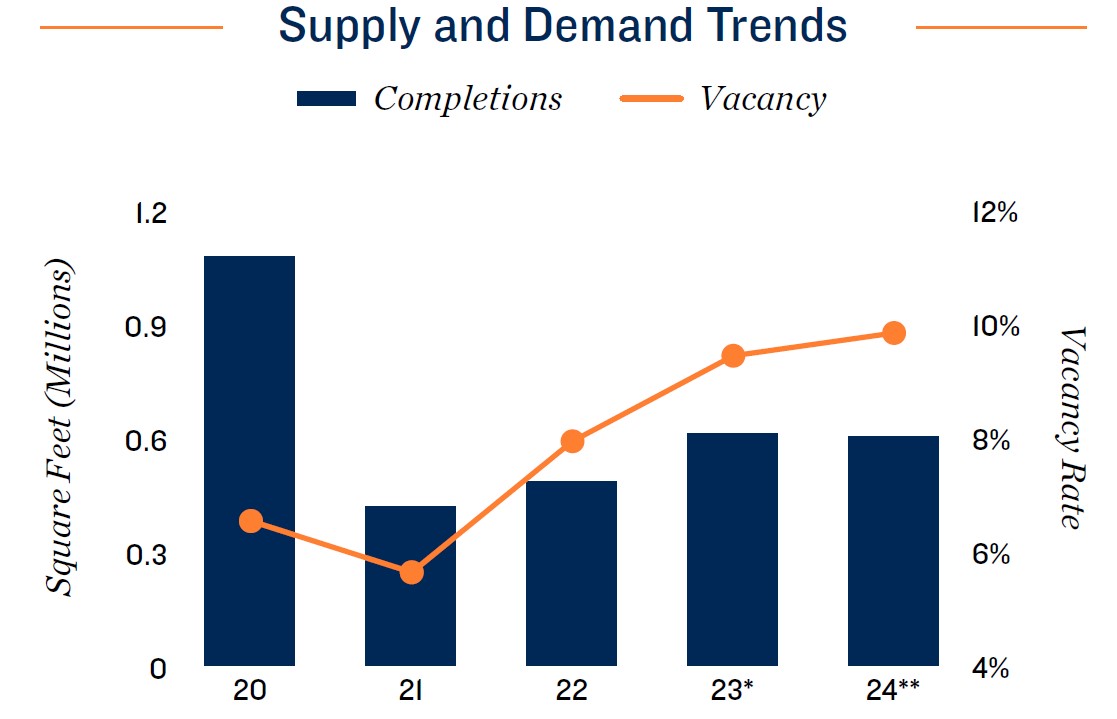

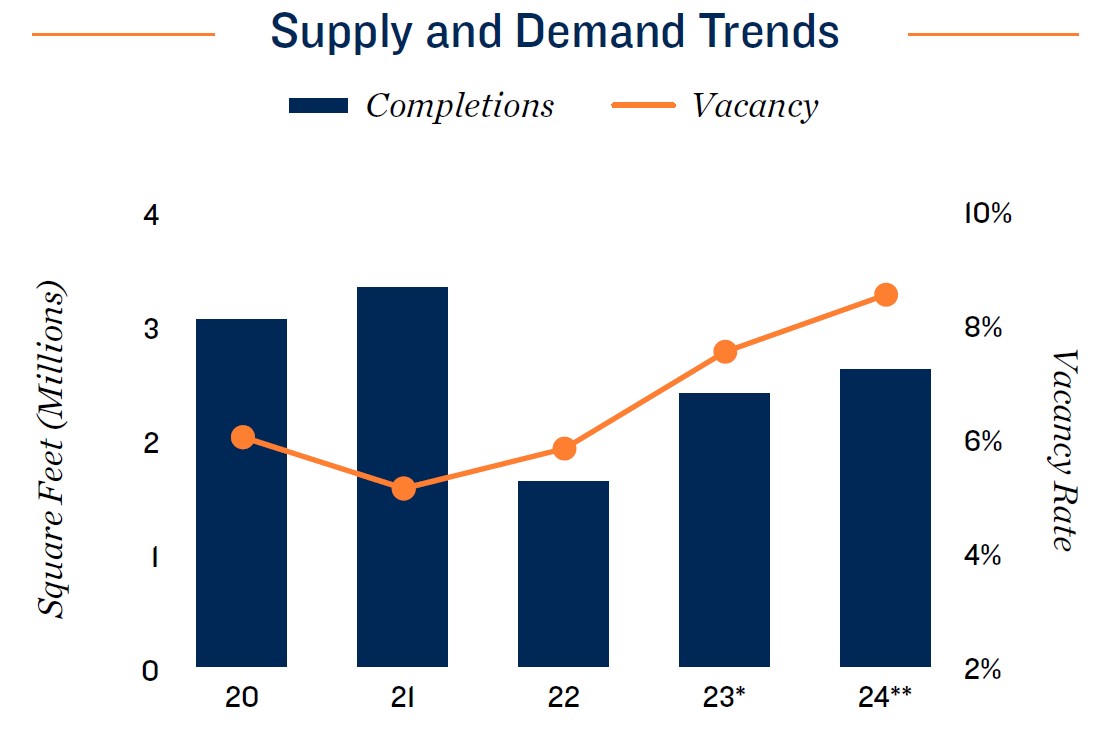

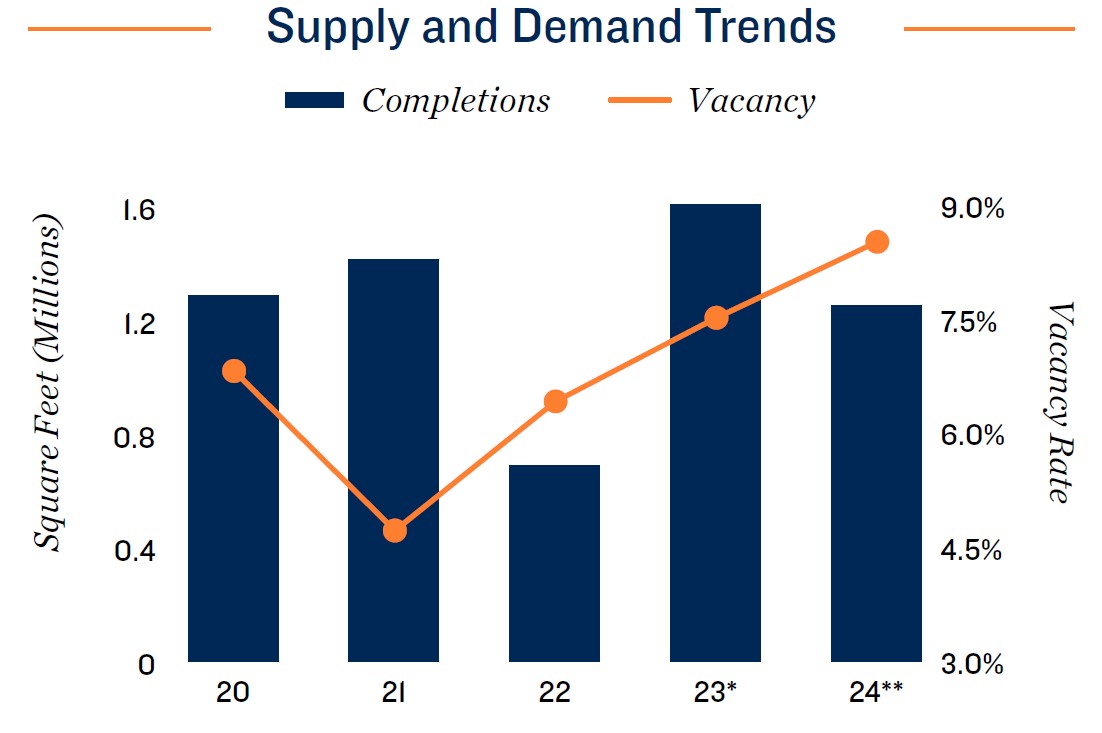

Construction Overview

Deliveries this year will fall nearly 140,000 square feet below the trailing two-decade average. While new space will be roughly in line with last year’s delivery total, tapering construction long-term is a positive sign for vacancy. Suburban areas that expect continued in-migration, like Taylor and San Marcos, are poised to absorb new supply well.

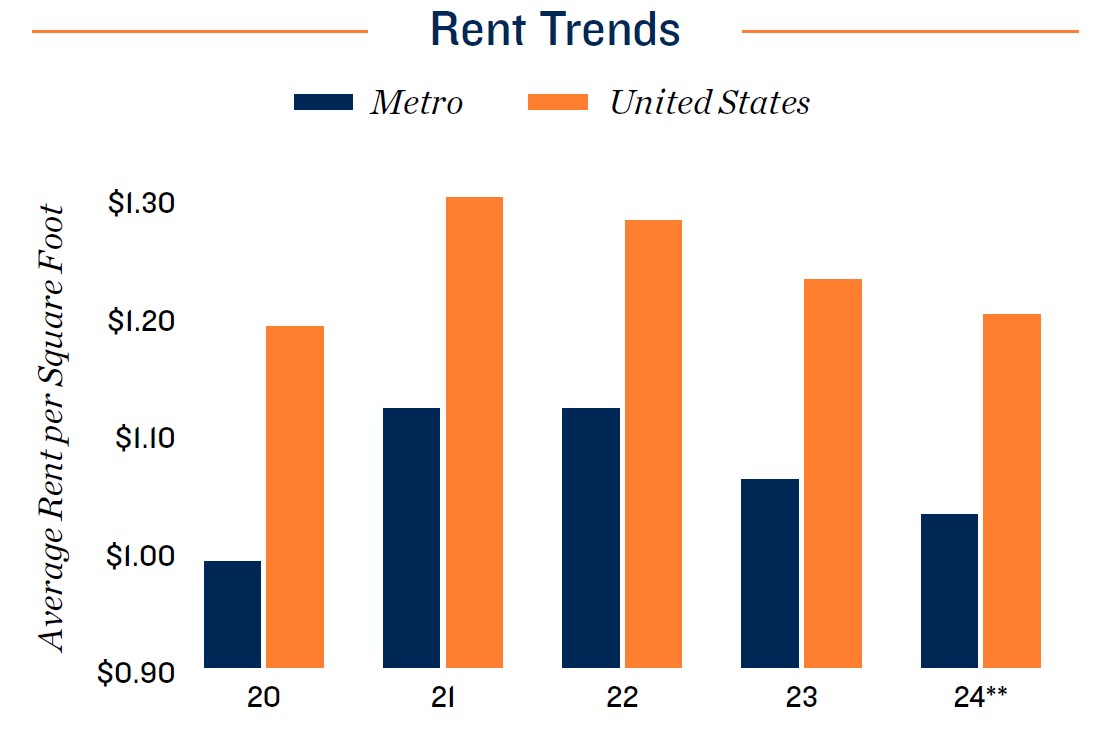

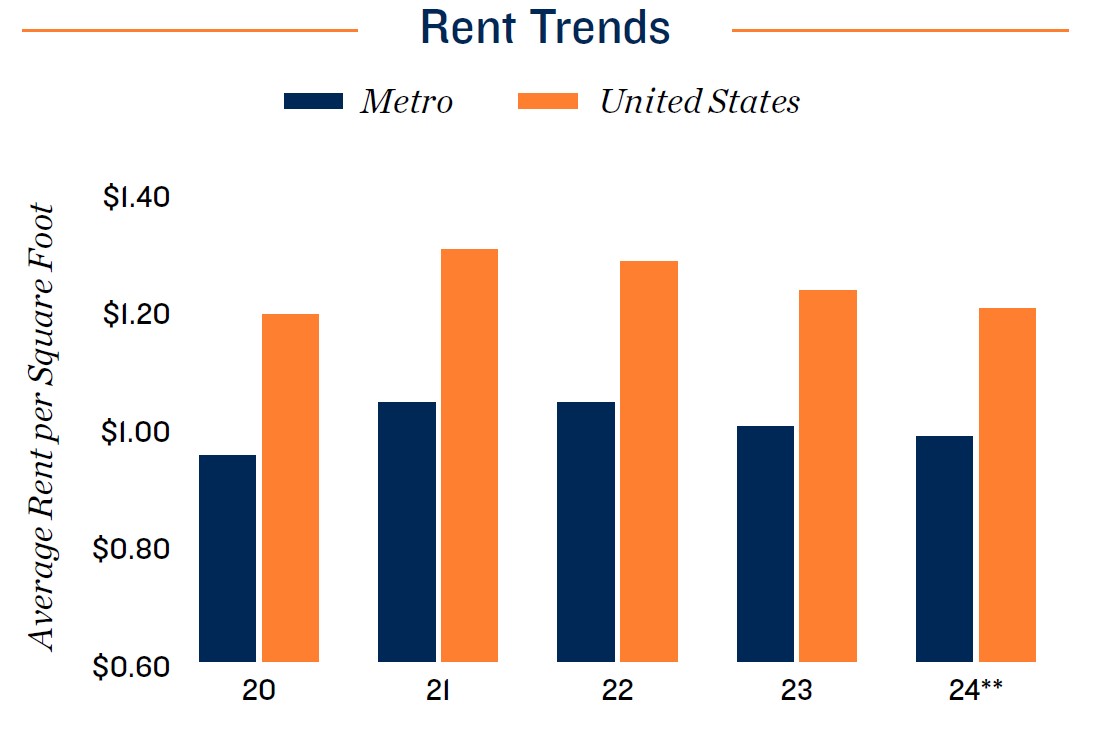

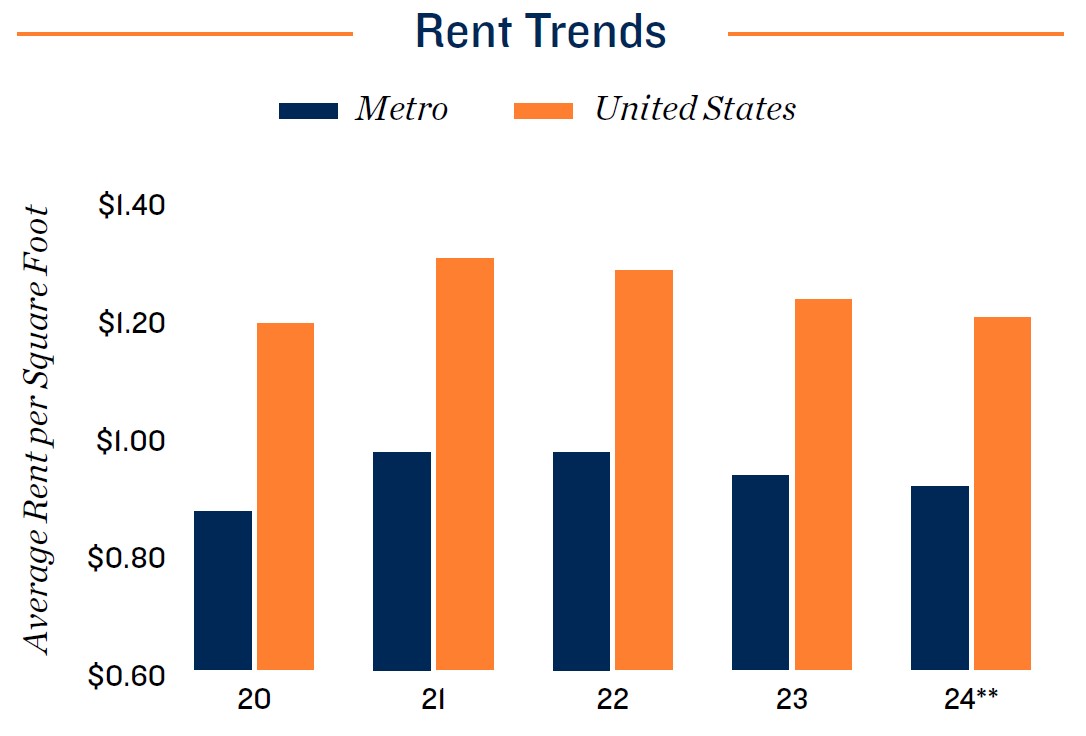

Vacancy/Rent Overview

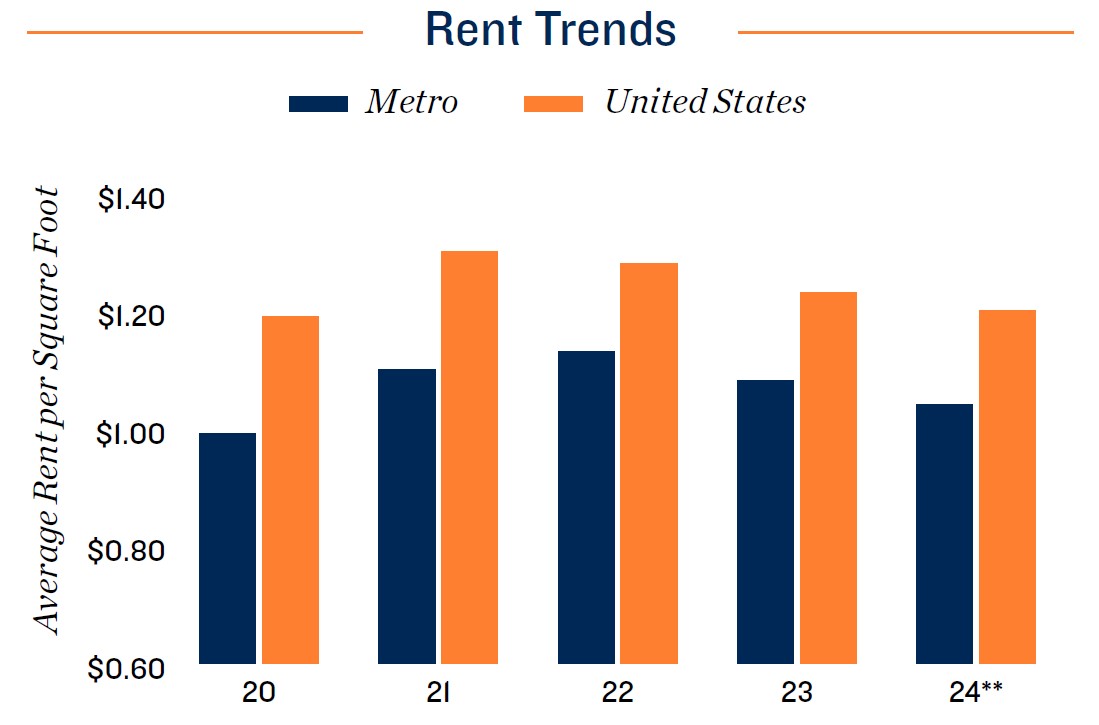

Vacancy will rise by the slowest year-over-year pace observed in the last three years, signaling that demand following pandemic-era disruptions is stabilizing. Still, the average asking rent will decrease slightly for the second straight period as operators contend with more competition to draw renters.

*Estimate; ** Forecast

Sources: CoStar Group, Inc.; Radius+; Yardi Matrix

DALLAS-FORT WORTH

Nation-Leading In-Migration a Construction Call Sign

Economic Trends

The Metroplex’s economy has soared following the pandemic, with local job creation and retail sales growth ranking among the strongest in the nation, backed by a number of high-profile corporate relocations and expansions. By year-end, the local employment base will stand 570,000 jobs ahead of its 2019 measure, while annual consumer spending lifts 51.5 percent ahead of the level recorded that same year.

Demographic Trends

Employment opportunities and a lower cost of living relative to other primary metros has spurred considerable net in-migration, a trend that will continue through 2024. More than 80,000 people are anticipated to move to Dallas-Fort Worth this year.

Construction Overview

Substantial population growth noted of late has driven developers to initiate the largest delivery slate in three years. Roughly two-thirds of new supply coming online will arrive in the greater Dallas area, while the remaining 880,000 square feet of completions service Fort Worth and surrounding counties.

Vacancy/Rent Overview

Despite robust in-migration and a strong labor market, the market’s vacancy rate continues to normalize this year. This will bring the measure closer in line with norms recorded prior to 2019. As a result, downward rent momentum is noted again in 2024, lowering the asking rate below $1.00 per square foot for the first time since early 2021.

*Estimate; ** Forecast

Sources: CoStar Group, Inc.; Radius+; Yardi Matrix

HOUSTON

Competition Among Facilities Rises in Growing Suburbs

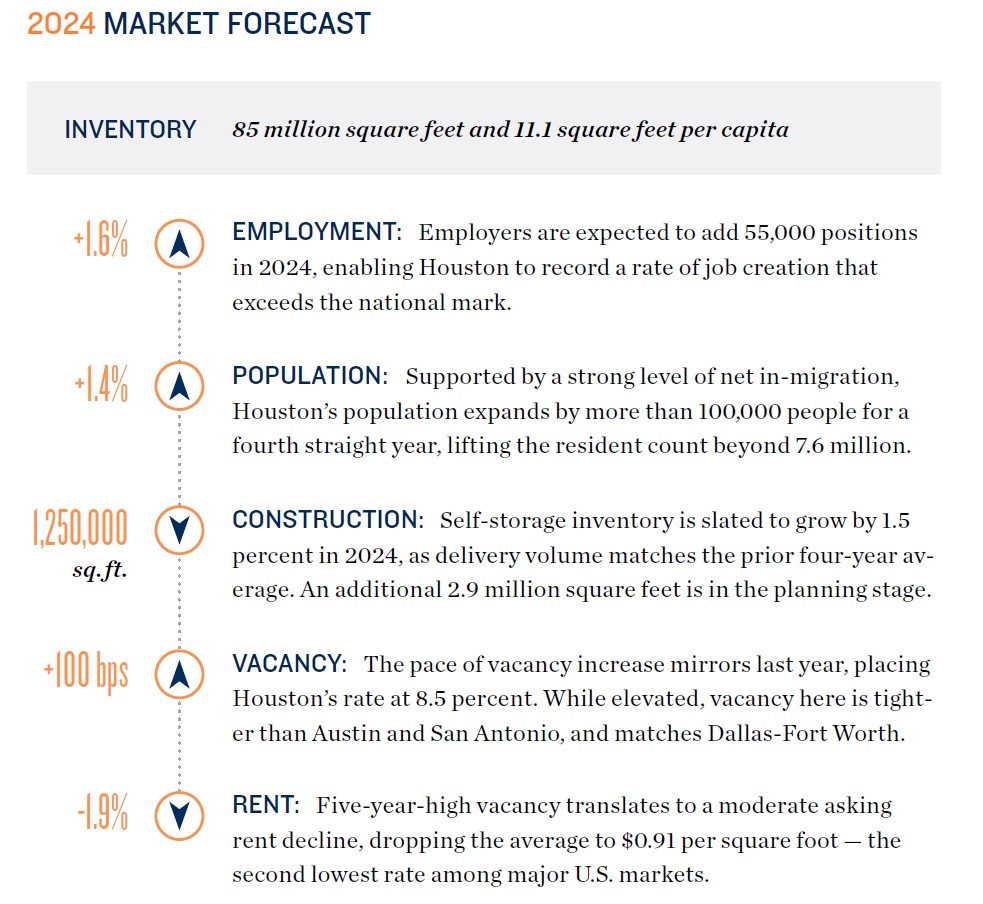

Economic Trends

All of Houston’s employment sectors, apart from the construction and information industries, noted job growth last year. Moving forward, certain segments remain poised for gains. The energy sector is positioned to notch both near- and longer-term gains, as the metro has been selected to house one of the nation’s seven clean hydrogen hubs, which will generate around 45,000 local jobs. The number of health services-related positions will also expand as population growth heightens demand for medical care.

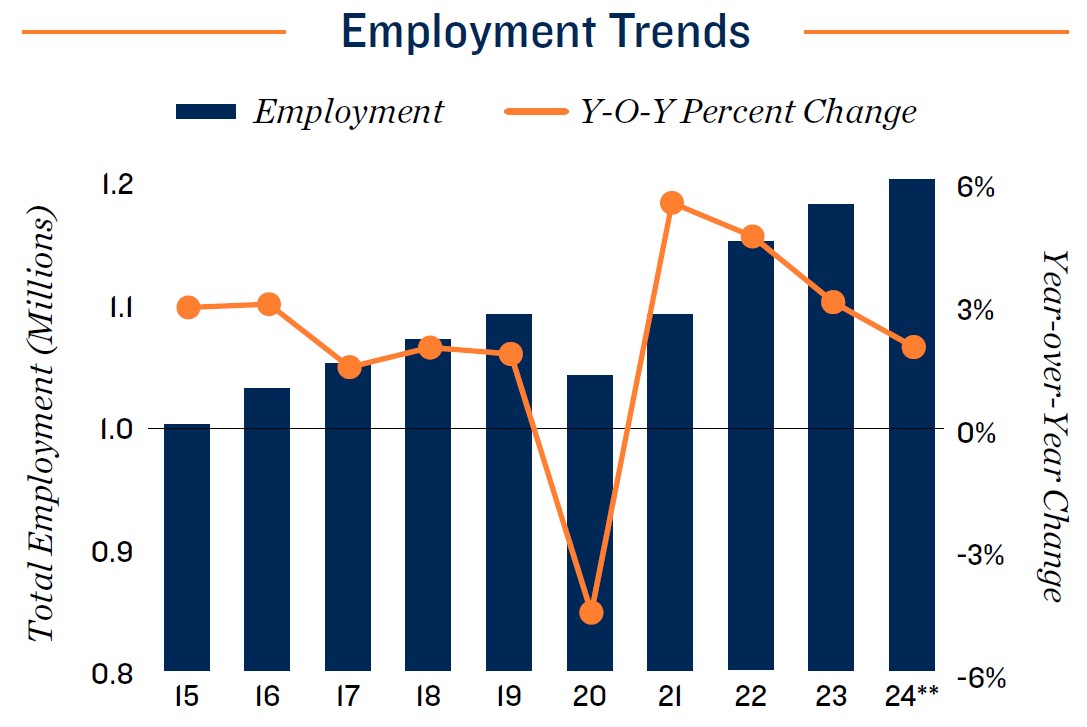

Demographic Trends

Supported by job opportunities and lower cost of living, Houston registers the second-largest net in-migration total among major markets this year. The metro’s 65-yearold-plus cohort also notes substantial growth of 3.8 percent during 2024, a boon for self-storage demand amid potential downsizing.

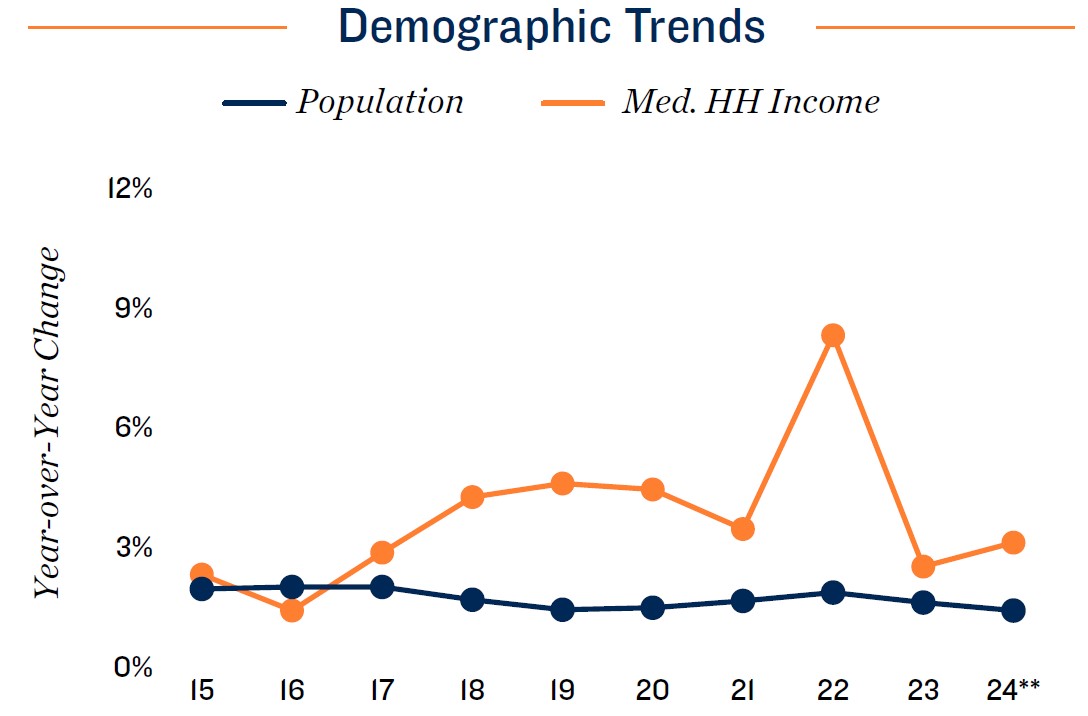

Construction Overview

Property completions scheduled for this year are concentrated in suburbs outside the Sam Houston Tollway, including the northern cities of Conroe, Tomball and Magnolia. Deliveries in the eastern half of the metro, however, are sparse.

Vacancy/Rent Overview

Houston’s vacancy rises by triple-digit basis points for a third consecutive year; however, the metro’s rate holds 10 basis points below its 2016-2019 mean. The average asking rent, meanwhile, hovers in the $0.90-to-$1.00-per-square-foot band for a fourth straight year.

*Estimate; ** Forecast

Sources: CoStar Group, Inc.; Radius+; Yardi Matrix

SAN ANTONIO

Decade-Low Delivery Slate Softens Rising Vacancy

Economic Trends

The pace of local employment growth will stand among the top 10 major U.S. markets this year. Entering 2024, gains made between 2020 and the end of 2023 have been most notable in professional and business services sectors. These roles typically offer higher wages and prompt additional discretionary spending, a boon for storage demand.

Demographic Trends

Net in-migration, and subsequently San Antonio’s population growth rate, slows in 2024. As a result, household formation growth will remain below the market’s longterm average. Nevertheless, the metro will record one of the largest increases of 20-to-34-year-old residents this year across the nation’s major markets.

Construction Overview

Elevated construction costs and rebalancing demand have prompted fewer development initiatives. As a result, the metro welcomes its smallest self-storage delivery slate since 2012. San Antonio proper is scheduled to account for more than half of all completed space this year. The long-term pipeline here amounts to more than 1.2 million square feet.

Vacancy/Rent Overview

After spiking 180 basis points in 2022, metro wide vacancy expansion will total less than one-third of this magnitude for a second straight year. Still, the measure lifts above 9 percent for the first time since 2019. Slowing demand is reflected in lowering asking rents, as the metro’s mean marketed rate falls again in 2024.

*Estimate; ** Forecast

Sources: CoStar Group, Inc.; Radius+; Yardi Matrix